Why Custom Home Financing is Your Key to Building Your Dream Home

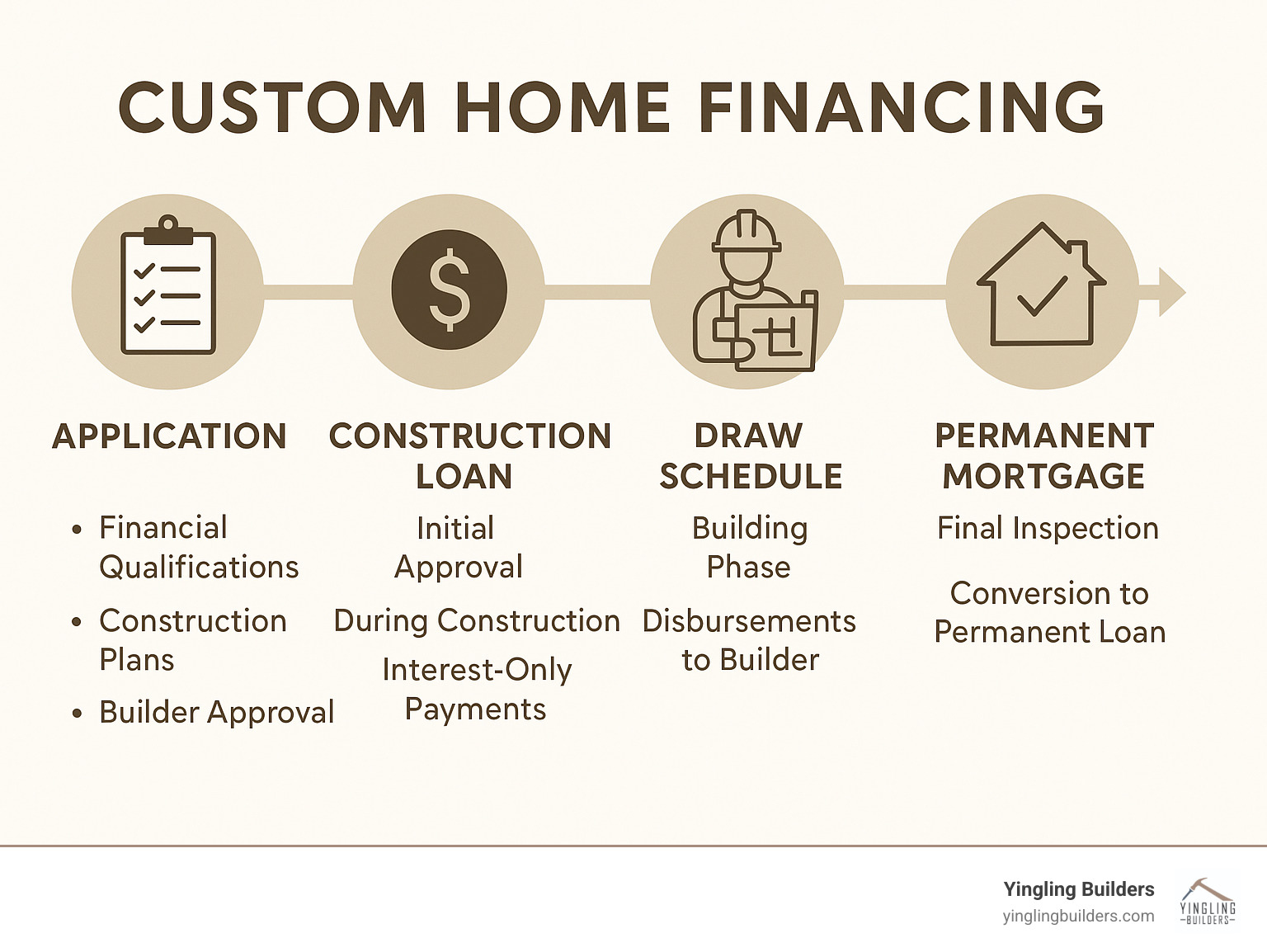

Custom home financing is the specialized lending process that makes building your dream home possible. It involves construction loans and permanent mortgages, which differ from traditional home financing by including things like construction-to-permanent loans, draw schedules, and builder approvals.

Quick Answer: Custom Home Financing Options

- Construction-to-Permanent Loans: Single closing, locked rates, converts automatically after build completion.

- Stand-Alone Construction Loans: Two closings, shop for permanent mortgage separately after construction.

- Down Payment: Typically 20-30% of total project cost.

- Loan Term: 12-18 months for construction, then converts to a 15-30 year mortgage.

- Interest: Pay interest-only during construction on disbursed amounts.

Building a custom home offers incredible advantages, like building equity from day one, avoiding major repairs, and creating an energy-efficient space custom to your family. While the financing process can seem complex, proper guidance makes it manageable.

Custom home financing has two phases: a short-term construction loan to fund the build via scheduled draws, and a permanent mortgage after completion. During construction, you typically make interest-only payments on the funds disbursed to your builder.

Your financing success depends on three critical factors: your financial qualifications, detailed construction plans and budget, and working with a reputable builder who lenders trust.

With years of hands-on experience guiding families through the custom home financing process, we know what lenders require and how to make your financing journey smooth, from loan application to final mortgage conversion.

Understanding Construction Loans: The Foundation of Your Build

A construction loan is the financial tool that makes your custom home possible. Unlike a traditional mortgage for an existing house, a custom home financing construction loan funds the process of building from the ground up. It’s a partnership with a lender who is investing in your future home before it’s even built.

Construction loans don’t provide a lump sum. Instead, lenders release funds in stages based on a draw schedule. After your builder completes a milestone, like the foundation, the lender inspects the work and releases the next payment. This system protects everyone: you only pay interest on money that has been used, your builder is paid as work progresses, and the lender’s investment is secure.

During the construction phase, typically lasting 12 to 18 months, you’ll make interest-only payments. This keeps your monthly payments lower than a full mortgage payment, and you only pay interest on the amount that’s been disbursed, not the total loan amount.

Lenders view construction loans as riskier than traditional mortgages because they’re lending on a home that doesn’t exist yet. Your future home is the collateral, so lenders need assurance that the project will be completed successfully. This is why they insist on working with experienced, reputable builders with proven track records.

How a Construction Loan Differs from a Traditional Mortgage

Construction loans and traditional mortgages serve completely different purposes.

Collateral is the biggest difference. With a traditional mortgage, the collateral is an existing house. With a construction loan, the collateral is your future home, which initially exists only on blueprints.

Loan terms are also different. Traditional mortgages span 15 to 30 years, while construction loans are short-term, typically lasting only 12 to 18 months to cover the building phase.

The disbursement method is a key distinction. Traditional mortgages provide funds in a lump sum at closing. Construction loans release funds in stages (draws) as work is completed and inspected.

Purpose is straightforward: a traditional mortgage helps you buy an existing home, while a construction loan funds the creation of your new custom home.

Interest rates on construction loans are typically variable and often slightly higher than traditional mortgages, reflecting the increased risk for lenders. However, you only pay interest on the money that has been disbursed.

Key Financial Benefits of Building a Custom Home

Building a custom home is not just about personalization—it’s a smart financial decision.

Building equity from day one is a major benefit. Often, by the time construction is complete, your home’s appraised value is higher than the cost to build it, giving you instant equity.

No immediate major repairs means peace of mind. Unlike older homes that may have hidden issues, your new home comes with warranties and all-new systems, saving you from unexpected, costly repairs.

Energy-efficient savings begin immediately. We build your home with the latest energy-efficient materials and systems, such as superior insulation and modern HVAC, which lowers your utility bills from the start.

Long-term value is improved by thoughtful design. A home built to perfectly suit your family’s lifestyle often translates to higher resale value down the road.

Types of Loans for Your Custom Home Project

When it comes to custom home financing, you have several paths to choose from. The main decision is whether you want a single loan for both construction and your permanent mortgage, or if you prefer to finance these phases separately. The right choice depends on your financial priorities and comfort level with the process.

We work closely with local lenders who understand the custom home financing market in West Central Illinois and can help you steer your options based on your unique situation.

Construction-to-Permanent (C2P) Loans

The Construction-to-Permanent (C2P) loan is the most popular option for custom home financing because it combines multiple steps into one simple tool. Most of our clients prefer this streamlined approach.

With a C2P loan, you go through the application and approval process just once. During construction, the loan releases funds in draws as we complete milestones, and you make interest-only payments. Once the home is finished, the loan automatically converts into a standard mortgage without a second application or closing.

The advantages of this single-close loan are significant. You lock in your permanent mortgage rate from the start, protecting you from market fluctuations during the build. Some lenders even offer a “float-down” option, allowing you to secure a lower rate if one becomes available.

The convenience of a single closing means one set of paperwork and one set of closing costs, simplifying the process while you focus on your build. The reduced closing costs are another benefit, as you avoid paying for a second loan closing, keeping more money in your pocket.

Stand-Alone Construction Loans

The stand-alone construction loan is for those who prioritize flexibility. This approach involves two separate loans: one for the construction phase and a second, traditional mortgage that you secure after the home is complete.

The main appeal is flexibility. Once your home is finished, you can shop around for the best available mortgage rates and terms. This freedom to choose your permanent lender might lead to a better deal if rates have dropped or new loan products have become available.

This two-closing process allows you to work with specialized lenders for each phase. You might use one lender for the construction loan and another for the permanent mortgage if it results in better overall terms.

However, this approach has trade-offs. You will face two sets of closing costs, which may offset any savings from a lower interest rate. There’s also rate risk; if interest rates rise during construction, you could face a higher permanent mortgage rate than you would have with a C2P loan.

Finally, the requalification process for the permanent mortgage means your finances will be reviewed again after the build. While usually not an issue, any change in your financial situation could complicate securing the final loan. These loans can be trickier to qualify for, but they are an excellent choice for homeowners who value flexibility.

The A-to-Z Guide to Your Custom Home Financing Journey

Starting on the custom home financing journey is an exciting trip. With a clear roadmap and the right guide, it’s a straightforward path to your dream home. From the first application to understanding your builder’s role, we’re here to help you steer every step.

The Application and Approval Process

Securing a construction loan is more involved than a traditional mortgage because the lender is financing a home that hasn’t been built yet. We’ll walk you through the key documents and what to expect.

First, lenders assess your financial readiness, including your credit score (typically 680+, with 725+ often securing better terms), debt-to-income (DTI) ratio, income, and assets. Being prepared with your documents can speed up the process. You’ll generally need:

- Proof of identity (driver’s license, social security card).

- Recent bank and investment account statements.

- Pay stubs, W-2s, and tax returns (past two years).

- A financial statement outlining your assets and liabilities.

- Documentation of land ownership if you already have the lot.

Next are your detailed building plans. Lenders require comprehensive architectural blueprints, floor plans, and detailed specifications for materials and finishes. You’ll also need a project timetable outlining each construction phase.

A builder contract and a detailed budget are also crucial. The budget must break down all costs, from excavation to interior finishes, to show the project is well-planned and financially feasible.

An appraisal based on the future value of your completed home will be conducted. The appraiser uses your plans and comparable sales of new homes in the area to estimate its worth upon completion.

During the process, you’ll receive a Loan Estimate detailing your terms and costs. Before closing, you’ll get a Closing Disclosure with the final terms and fees. It’s vital to review these documents carefully. For more information, the Consumer Financial Protection Bureau offers a helpful guide: What Is a Construction Loan?.

The Builder’s Role and How Lenders Vet Them

Your builder plays a critical role in the custom home financing process. Lenders vet your builder as thoroughly as they vet you. Since the home doesn’t exist yet, lenders rely on the builder’s reputation, experience, and financial stability to ensure the project will be completed successfully and on budget.

Here’s what lenders look for, and why partnering with a reputable firm simplifies the process:

Lenders verify licensing and insurance. They require builders to be properly licensed and carry comprehensive insurance, including General Liability and Builder’s Risk Insurance. We ensure all our documentation is in perfect order for your lender.

Lenders also review a builder’s financial stability and project history. They look for a healthy financial track record and a history of successfully completed projects. Our extensive portfolio and long-standing relationships with suppliers in West Central Illinois demonstrate our reliability.

A builder’s reputation is key. Lenders check standings with organizations like the Better Business Bureau. Our commitment to quality and transparency helps us sail through these checks, smoothing the financing process for you.

Finally, lenders require detailed contracts and clear communication. They want to see comprehensive contracts that outline the project scope, budget, and timeline. We pride ourselves on our transparent process and provide all necessary documentation promptly to keep your loan application moving.

While “owner-builder” loans exist, they are much harder to qualify for due to the higher risk. For most homeowners, partnering with an experienced, vetted builder like us simplifies financing and construction immensely.

Managing Your Build: From Groundbreaking to Move-In Day

Once your custom home financing is approved and construction begins, the focus shifts to managing the build. This exciting phase involves careful project management and financial oversight, and we’re with you every step of the way.

During construction, funds are released in “draws” after specific milestones are met and inspected by the lender’s representative. This ensures work is progressing to quality standards before the next payment is released. We also collect lien waivers from all subcontractors and suppliers, confirming they’ve been paid and protecting you from future claims.

Staying on Budget During Construction

Keeping a close eye on your budget is essential. Here are our top tips for staying on track:

-

Contingency Fund (10-15%): We strongly advise setting aside an extra 10-15% of your total project budget. This fund acts as a financial cushion for unexpected costs, like material price changes or minor design tweaks, ensuring a smoother, less stressful build.

-

Managing Change Orders: While new ideas can arise during construction, every change can impact your budget and timeline. We use a clear, written process where all changes are priced and approved by you before work begins. Minimizing changes is key to staying on budget.

-

Regular Builder Meetings: Communication is vital. We schedule regular meetings to discuss progress, answer questions, and review financial updates. These check-ins ensure everyone is on the same page and help address potential issues early.

-

Tracking Expenses: We provide clear billing and expense tracking so you can see how costs align with your budget. This transparency helps you monitor spending and catch any discrepancies quickly.

-

Purchasing Wisely: We guide you in selecting materials that offer great value without overspending. We also obtain multiple bids from trusted subcontractors to ensure competitive pricing.

After Construction: Converting Your Custom Home Financing to a Permanent Mortgage

Finishing your custom home is a huge milestone, but a few final steps remain in the custom home financing process.

First are the final inspections. Local authorities will ensure your home meets all building codes, and your lender will conduct a final check to confirm the project was completed as planned.

Once inspections are passed, you’ll receive a Certificate of Occupancy (CO). This official document certifies your home is safe and legal to live in. It’s required before you can move in or convert your loan.

After the CO is issued, the final draw of your construction loan is released, paying any remaining balances to your builder and suppliers.

Finally, the loan conversion process begins, turning your temporary construction loan into a long-term mortgage.

-

With a Construction-to-Permanent (C2P) loan, this conversion is typically automatic. Your loan rolls into the permanent mortgage terms you already agreed upon, and you begin making principal and interest payments.

-

With a Stand-Alone Construction loan, you’ll apply for a new, traditional mortgage. This involves a second approval process and closing. The funds from this new mortgage pay off the construction loan.

Once the conversion is complete, you’ll begin your regular principal and interest payments, officially starting your homeownership journey in your new custom home. We ensure all necessary paperwork is ready for your lender to make this transition as smooth as possible.

Conclusion

Navigating custom home financing might seem complex, but it’s a manageable process that leads to your dream home. With the right guidance, each step is straightforward. The financing is designed to work for you, whether you choose the convenience of a construction-to-permanent loan or the flexibility of a stand-alone loan.

What makes the difference is having the right team. We’ve helped families in West Central Illinois steer this process since 2019, and we know what lenders require. We manage the details to keep your project on track and on budget.

The financial benefits are significant: you build equity immediately, avoid the costly repairs of older homes, and enjoy long-term energy-efficient savings. These are real advantages that positively impact your family’s financial future.

Successful custom home building starts with a solid plan. With detailed blueprints, a realistic budget, and a builder who understands construction financing, the entire process becomes much less stressful. We pride ourselves on being that reliable partner.

Your dream home is an achievable goal. With our expertise in West Central Illinois construction and our streamlined approach, we’re here to turn your vision into reality without the financial headaches.

0 Comments