Why Understanding New Construction Financing Matters

New construction financing is a specialized loan designed to fund the building of a custom home from the ground up. Unlike a traditional mortgage, it releases funds in stages as your home is built, making it a unique financial tool that requires careful planning.

Quick Overview of New Construction Financing:

- Purpose: Covers land, materials, labor, permits, and all construction costs.

- Process: Funds are released in “draws” at key construction milestones.

- Terms: Short-term (12-18 months) with interest-only payments during the build.

- Requirements: Typically a 20-25% down payment and a credit score of 680 or higher.

- Types: Construction-to-permanent (one closing) or stand-alone (two closings).

Building a custom home in West Central Illinois is a significant investment, and the financing process can feel complex. Start with our pre-construction steps—site and budget review, preliminary plans and scope, and lender coordination—then schedule your consultation to map your financing and next milestones.

This guide breaks down everything you need to know about financing your new home, from understanding loan types to managing the draw schedule during your build.

The Anatomy of a Construction Loan: What It Is and How It Works

New construction financing works very differently from a traditional mortgage. A construction loan is a short-term financing solution that funds your home as it’s being built. Instead of a lump sum, money is released in stages, or “draws,” as the project reaches milestones like pouring the foundation or completing the framing.

This phased approach mitigates risk for the lender, as their collateral is an evolving construction site rather than a finished home. Consequently, these loans have unique terms. During the short-term construction phase, you’ll make interest-only payments on the funds disbursed so far. Interest rates are often variable and tend to be higher than conventional mortgage rates. The approval process is also more stringent, requiring detailed plans and a thorough vetting of your builder.

Here’s how construction loans stack up against traditional mortgages:

| Feature | Construction Loan | Traditional Mortgage |

|---|---|---|

| Purpose | Funds the building of a new home | Funds the purchase of an existing home |

| Term | Short-term (for the duration of the build) | Long-term (e.g., 15, 20, or 30 years) |

| Disbursement | Phased “draws” as construction progresses | Lump sum at closing |

| Interest Rate | Typically higher and often variable during construction | Generally lower and often fixed for the loan term |

| Payments | Often interest-only during construction | Principal and interest from the start |

| Collateral | Unfinished home, plans, and land | Completed home |

| Risk to Lender | Higher, as collateral is an incomplete asset | Lower, as collateral is a finished, valued asset |

| Approval | More stringent, requires detailed plans & builder vetting | Based on property appraisal & borrower’s financial health |

Types of New Construction Financing

You’ll generally choose between two main structures for your new construction financing:

The construction-to-permanent loan (C2P) is a streamlined, single-closing option. You apply once and pay one set of closing costs. When construction is complete, the loan automatically converts into a traditional mortgage. Many C2P loans let you lock in your permanent mortgage rate at the start, providing predictability.

The stand-alone construction loan involves two separate transactions: one loan for construction and a second, permanent mortgage once the home is finished. This means two applications and two closings, but it offers the flexibility to shop for the best permanent mortgage rates upon completion.

A third, less common option is the owner-builder loan, designed for licensed general contractors building their own homes. These require extensive proof of building experience and credentials.

Understanding Rates, Terms, and Associated Costs

Budgeting for your custom home requires understanding the key numbers. Interest rates on construction loans are higher to reflect the lender’s risk and are typically variable during the build. A C2P loan may allow you to lock in your permanent rate upfront.

The loan term for construction is short, typically for the duration of the build. During this time, your monthly payments are interest-only on the funds drawn to date, which helps manage cash flow. Closing costs are a percentage of the loan amount. A C2P loan has one set of closing costs, while a stand-alone loan has two.

The Path to Approval: Your Guide to Securing a Construction Loan

Securing new construction financing is more involved than a traditional mortgage because lenders must evaluate both your finances and the entire vision for your home. While thorough, the process is manageable with an experienced team in your corner. We’ve guided countless clients in West Central Illinois through this journey and know what lenders require.

Eligibility Requirements for New Construction Financing

Lenders look for a strong financial foundation. Key requirements typically include:

- Credit Score: A strong credit score.

- Debt-to-Income (DTI) Ratio: A low DTI ratio demonstrates your ability to handle the new loan payments.

- Steady Income: Proof of reliable income through pay stubs, W-2s, and tax returns from the past two years.

- Down Payment: A significant down payment. If you already own your land, its equity can often be used toward this requirement.

- Financial Reserves: Liquid assets to cover potential cost overruns or unexpected expenses.

For a personalized conversation about how your financial situation aligns with these requirements, we invite you to explore custom home financing options with our team.

Assembling Your Application Package

A comprehensive application package tells the full story of your financial readiness and project viability. You will need to provide personal financial documents (tax returns, bank statements, pay stubs) and detailed project documentation.

The project-specific items include:

- A signed construction contract with Yingling Builders outlining the scope, costs, and timeline.

- Comprehensive architectural drawings and a detailed list of materials and specifications.

- A construction schedule with timelines for each building phase.

- Proof of land ownership or a purchase agreement.

As your builder, we provide our own credentials, including licensing, insurance, and financial statements, to give lenders the confidence they need. We work with you to ensure the entire package is accurate and complete.

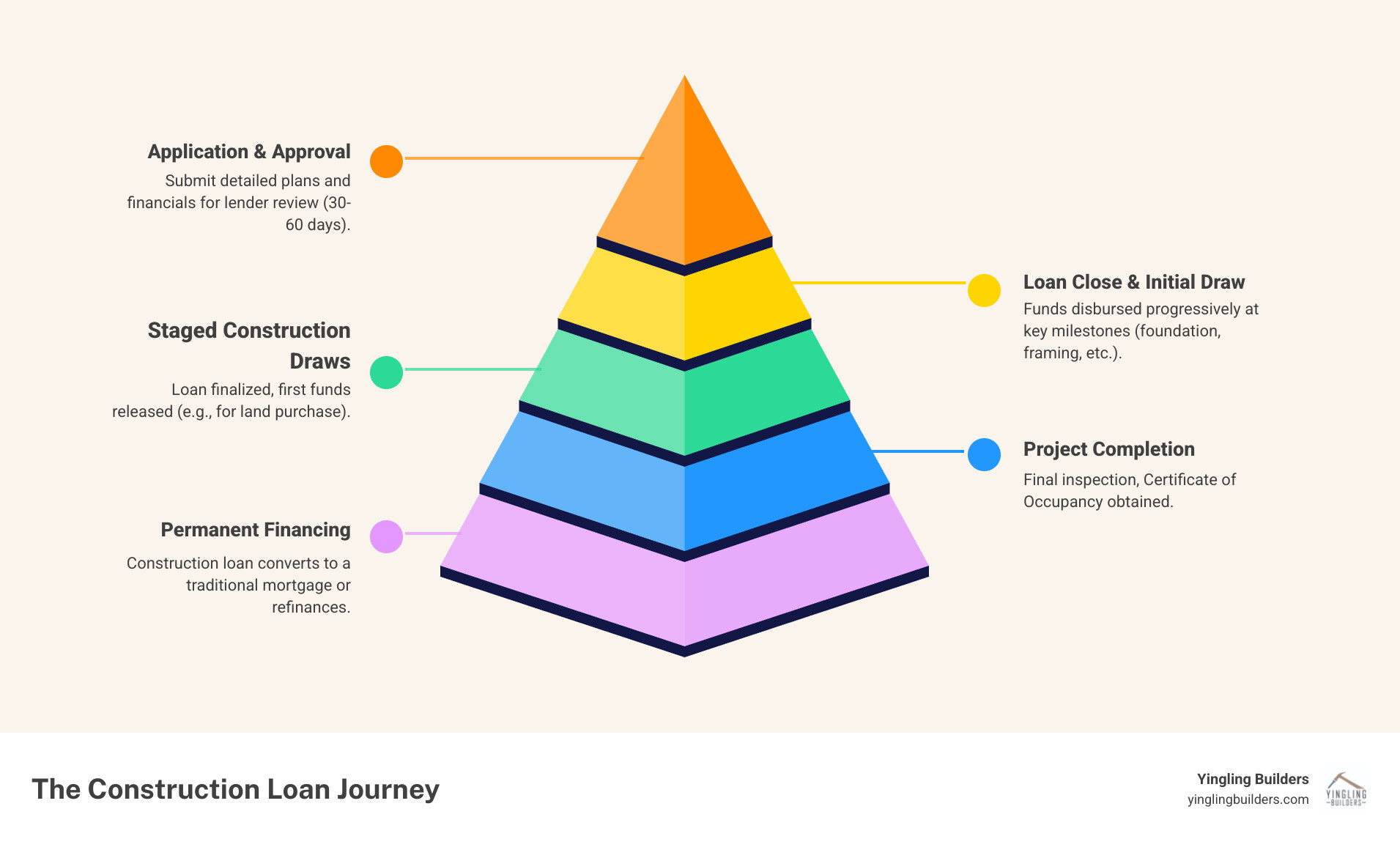

The Approval Timeline and Process

Expect the approval process to take several weeks. It begins with pre-qualification to establish your borrowing capacity. After submitting the complete application, the lender moves into underwriting.

During underwriting, the lender reviews your finances and the construction plans. This includes two critical steps:

- Builder Vetting: The lender verifies that Yingling Builders has the expertise, financial stability, and track record to complete your project successfully. Our reputation in West Central Illinois is a key asset in this process.

- Appraisal of Future Value: An appraiser estimates the market value of your home once completed. This “as-completed” value is crucial for determining the final loan amount.

Once all conditions are met, you’ll receive loan approval and proceed to closing. This detailed approach ensures your project is set up for success from the start. Before you begin, it’s helpful to review what to consider before building your dream home.

From Groundbreaking to Move-In: Managing Your Construction Loan

Once your new construction financing is approved, managing the loan is a collaborative effort between you, your lender, and us. This phase is where your vision for a custom home in West Central Illinois begins to take shape.

The Draw Schedule: How Your Project Gets Funded

A construction loan is funded through a “draw schedule.” Instead of a lump sum, the lender releases funds in stages as construction milestones are met. Before work begins, we establish these milestones (e.g., foundation, framing, mechanicals) with your lender.

At each stage, an inspector verifies the completed work. Once approved, we submit a draw request with necessary documentation, including lien waivers confirming subcontractors have been paid. This protects your property and keeps the project moving. Funds are then disbursed to cover labor and materials, and you continue making interest-only payments on the amount drawn to date.

The Builder’s Critical Role in the Loan Process

As your builder, Yingling Builders is your financial partner throughout construction. We provide the lender with the detailed plans and cost breakdowns needed to establish the draw schedule. During the build, we manage all draw requests, coordinate with inspectors, and handle the paperwork to ensure funds are released on time.

Our commitment to efficient construction and proactive communication helps keep your project on schedule and within budget, ensuring a smooth draw process. This attention to detail is central to our stress-free building experience. You can see the results of our process in our portfolio of custom homes and renovations.

From Construction Loan to Permanent Mortgage

As construction finishes, the loan transitions to long-term financing. This begins with a final inspection from the lender and the issuance of a Certificate of Occupancy from local authorities, confirming your home is ready.

The next step depends on your loan type:

- Construction-to-Permanent Loan: The loan automatically converts to a permanent mortgage. You’ll begin making principal and interest payments with no second closing.

- Stand-Alone Construction Loan: You will pay off the construction loan by securing a new, traditional mortgage. This requires a second application and closing but allows you to shop for current interest rates.

This final step transforms your temporary construction financing into a stable, long-term investment in your custom home.

Frequently Asked Questions About New Construction Financing

Financing a custom home can bring up many questions. Here are answers to some of the most common inquiries we receive from our clients in West Central Illinois about new construction financing.

How much of a down payment is required?

For new construction financing, lenders typically require a significant down payment. This is higher than for a traditional mortgage because of the increased risk associated with financing a home that is not yet built.

However, if you already own the land where you plan to build, its appraised value can often be used as equity toward your down payment. This can significantly reduce the amount of cash you need to provide out of pocket.

Can I use a construction loan to buy the land?

Yes, in many cases. A construction loan can often be structured to cover both the land purchase and the home construction. In this scenario, the first draw from your loan is used to acquire the property, consolidating your financing into a single package. Some lenders may prefer you to own the land beforehand, so it’s an important detail to discuss early in the planning process.

What happens if the project goes over budget or past the deadline?

Even with careful planning, unexpected issues can arise. This is why we strongly recommend a contingency fund. This fund acts as a financial safety net to cover unforeseen expenses without disrupting the project. If costs exceed the budget, you would typically use your contingency fund or personal savings to cover the difference.

Construction loans have a fixed term, typically for the duration of the build. If delays occur, your lender may offer a loan extension, which could come with additional fees or a higher interest rate. The key to managing these risks is proactive communication. At Yingling Builders, we keep clients and lenders informed to address challenges head-on, ensuring your project stays on track. Our efficient process is designed to minimize delays and keep your build moving forward smoothly.

Conclusion: Building Your Vision with a Trusted Partner

Understanding new construction financing is a critical step in bringing your custom home to life. While the process is detailed, it is a proven path to creating a home you will love for years to come.

At Yingling Builders, we are more than just builders; we are your partners in the journey. We guide you through every step, from securing the right new construction financing with trusted local lenders to handing you the keys. Our expertise in the financial side of building ensures a process that is as seamless as possible.

Our commitment is to enduring quality and an improved lifestyle. Using customizable home plans and superior materials, we build homes in West Central Illinois designed for how you live. Our efficient process and transparent communication mean you can focus on the excitement of your new home while we manage the complexities. The results are visible in every project in our portfolio of custom homes and renovations.

Ready to take the next step? Whether you’re exploring options or ready to discuss plans, we’re here to help. Contact us to start your custom home journey today, and let’s build something beautiful together.

0 Comments